IIFL Samasta plans to raise Rs. 1,000 crores through bonds with a potential annual return of 10.50%

New Delhi: IIFL Samasta Finance, a major NBFC-MFI in India, plans to raise Rs. 1,000 crores through its first public issue of secured bonds for business growth. The bonds offer up to 10.50% returns with a high level of safety. The issue period is from December 4 to December 15, 2023. IIFL Samasta is a part of IIFL Finance, one of India’s largest retail-focused NBFCs with loan assets totaling Rs. 73,066 crores.

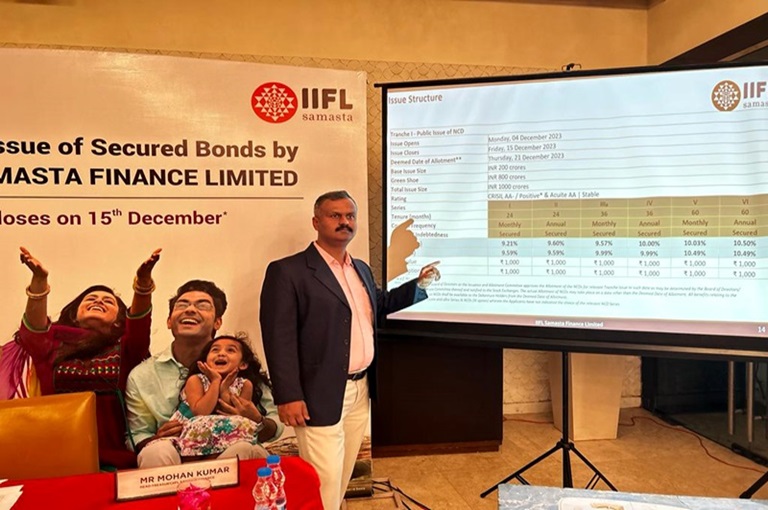

IIFL Samasta Finance will issue bonds, aggregating to Rs 200 crore, with a green-shoe option to retain over-subscription of up to Rs 800 crore (aggregating to a total of Rs 1,000 crore). The IIFL Samasta bonds offer highest coupon rate of 10.50% per annum for tenor of 60 months. The NCD is available in tenors of 24 months, 36 months and 60 months. The frequency of interest payment is available on monthly and annual basis for each of the series.

Mr Mohan Kumar, Head – Treasury, IIFL Samasta Finance said, “IIFL Samasta Finance has a strong physical presence of across India through about 1,500 branches. It caters to the credit needs of underserved and unserved population, primarily women entrepreneurs from underprivileged background through a well-diversified portfolio. The funds raised will be used to meet credit demand from more such customers and bolster business growth.”

IIFL Samasta Finance provides affordable financial products to women in unbanked sections through Joint Liability Groups. This includes a diverse range of occupations across rural, semi-urban and urban areas in India.