Earn Up to 10.5% with IIFL Samasta's Rs. 1,000 Crore Bond Issue

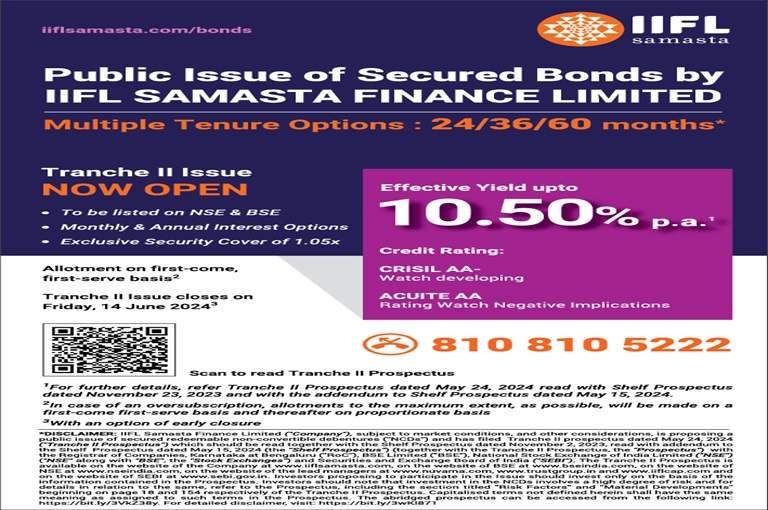

Karnal: IIFL Samasta Finance, which is one of India’s largest non-banking microfinance companies (NBFC-MFI), will raise up to Rs 1,000 crores through public issue of secured bonds, for the purpose of capital augmentation and business growth. The bonds offer up to 10.50% and high degree of safety. The issue opens on Monday, June 3, 2024 and closes on Friday, June 14, 2024.

IIFL Samasta Finance will issue bonds, aggregating to Rs 200 crore, with a green-shoe option to retain over-subscription of up to Rs 800 crore (aggregating to a total of Rs 1,000 crore). The IIFL Samasta bonds offer highest coupon rate of 10.50% per annum for tenor of 60 months. The NCD is available in tenors of 24 months, 36 months and 60 months. The frequency of interest payment is available on monthly and annual basis for each of the series.

The credit rating is “CRISIL AA-/Watch Developing” by CRISIL Ratings Limited and “Acuite AA| Rating Watch Negative Implication” by Acuite Ratings and Research Limited.

IIFL Samasta Finance’s MD and CEO Mr. Venkatesh N said, “IIFL Samasta Finance has a strong physical presence of across India through about 1,500 branches. It caters to the credit needs of underserved and unserved population, primarily women entrepreneurs from underprivileged background through a well-diversified portfolio. The funds raised will be used to meet credit demand from more such customers and bolster business growth.”

IIFL Samasta Finance offers innovative and affordable financial products to women who are enrolled as members and organized as Joint Liability Group from unbanked sections in society including encompassing cultivators, agricultural laborers, vegetable and flower vendors, cloth traders, tailors, craftsmen, as well as household and industrial workers across rural, semi urban and urban areas in India.

IIFL Samasta Finance also reported record net profit of Rs 503.05 crore for the financial year 2023-2024, while loan assets under management rose 34.67% year-on-year to a record Rs 14,211.28 crore. IIFL Samasta Finance’s customer count has increased from 23.54 lakh customers as of March 31, 2023 to 30,01 lakh customers as of March 31, 2024, mostly women in smaller rural and semi-urban locations across India. IIFL Samasta Finance, which is a subsidiary of retail-focused non-banking financial company, IIFL Finance Limited, has been one of the fastest growing and most resilient microfinance institutions in India.

IIFL Samasta Finance has consistently maintained low level of NPAs over the years of operations and continues to focus on good quality assets. IIFL Samasta Finance’s net non-performing assets (NPA) stood at 0.34% at the end of FY24, while gross NPA was at 1.91%. The company’s net worth rose 51% year-on-year to Rs 1,919.99 crore. IIFL Samasta Finance has a widespread network of 1,648 branches spanning the length and breadth of the country and has a strong workforce of 16,519 employees (including trainees)

In April 2024, former Chairman of NABARD, Dr. Govinda Rajulu Chintala joined IIFL Samasta as Chairman of the board. Former Managing Director of Equifax Credit Information Services Mr. Kalengada Mandanna Nanaiah and Co-promoter of IIFL Group, Mr. R. Venkataraman have also joined the board. Mr Venkataraman joined as Additional Director(non-executive), while Dr. Chintala and Mr. Nanaiah joined as Additional Director (non-executive and Independent). The Board will now comprise of six members.

The lead managers to the issue are Trust Investment Advisors Private Limited, Nuvama Wealth Management Limited and IIFL Securities Limited. The NCDs will be listed on the BSE Limited and National Stock Exchange of India Limited (NSE), to provide liquidity to the investors. The NCDs would be issued at face value of Rs 1,000 and the minimum application size is Rs 10,000 across all categories. The public issue opens on Monday, June 3, 2024 and closes on Friday, June 14, 2024, with an option of early closure. The allotment will be made on first come first served basis.